The Ultimate Guide To Offshore Trust Services

Table of ContentsHow Offshore Trust Services can Save You Time, Stress, and Money.The Of Offshore Trust ServicesSome Known Factual Statements About Offshore Trust Services Get This Report on Offshore Trust ServicesOffshore Trust Services Fundamentals Explained

Also if a financial institution can bring a fraudulent transfer claim, it is hard to do well. They must confirm beyond an affordable question that the transfer was made with the intent to rip off that specific creditor and also that the transfer left the debtor bankrupt. Several overseas property protection prepares include greater than one lawful entity.

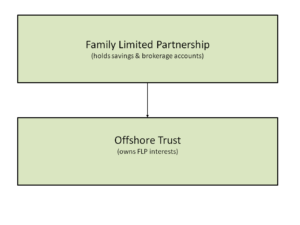

local can establish an offshore depend on as well as a united state restricted collaboration or an overseas minimal liability business. Many offshore LLCs are formed in Nevis, which for a long time has been a preferred LLC territory. Nonetheless, current changes to Nevis tax and filing demands have actually brought about LLCs in the Chef Islands.

The individual might next develop a Cook Islands trust fund utilizing an overseas trust fund business as a trustee. The LLC concerns membership interests to the trustee of the Chef Islands count on.

With this type of overseas count on framework, the Nevis LLC is taken care of by the United state individual when there are no expected lawsuits. When a legal problem occurs, the trustee of the offshore trust fund must eliminate the U.S

Supply all called for documents for the trustee's due persistance. Compose the overseas trust record with your lawyer. Fund the trust by transferring domestic possessions to the offshore accounts. The initial step to forming an offshore trust fund is picking a trust fund territory. offshore trust services. In our experience, the Chef Islands supplies the most effective combination of trustee law, favorable borrower regulations, as well as favorable litigation end results contrasted to various other territories.

The trustee company will certainly use software program to validate your identification and examine your existing legal circumstance in the U.S. Depend on firms do not want customers who may include the company in examinations or lawsuits, such as conflicts involving the united state government. You must disclose pending litigation as well as investigations as part of the history check.

10 Easy Facts About Offshore Trust Services Explained

Many people pass the history check without problem. Your domestic property security lawyer will deal with the offshore trustee business to prepare the overseas count on contract. If you consist of various other entities in the structure, such as a Nevis LLC, the attorney will likewise compose the arrangements for those entities. The trust fund arrangement can be tailored based upon your possession defense as well as estate preparation objectives.

accounting firms, and also they supply the audit results as well as their insurance certifications to possible offshore trust fund clients. Most individuals would certainly such as to retain control of their own possessions kept in their offshore count on by having the power to eliminate and replace the trustee. Maintaining the power to change an offshore trustee develops legal threats.

Overseas trust fund property protection functions best if the trustmaker has no control over depend on possessions or various other events to the trust fund. Some trustee companies permit the trustmaker to reserve primary discernment over trust financial investments as well as account monitoring in the setting of count on advisor.

The trustmaker does not have straight access great post to read to offshore depend on financial accounts, yet they can ask for distributions from the offshore trustee The opportunity of turnover orders as well as civil contempt fees is a substantial risk in overseas asset defense. Debtors relying upon overseas trust funds must consider the possibility of a domestic court order to bring back properties moved to a borrower's offshore depend on.

In circumstances when a court orders a debtor to take a break an overseas count on strategy, the debtor can declare that conformity is impossible due to the fact that the trust is under that site the control of an offshore trustee. Some recent court choices deal with a transfer of properties to an overseas trust as a willful act of developing an unfeasibility.

The borrower had actually moved over $7 million to an overseas trustee. The trustee then transferred the very same money to a foreign LLC of which the debtor was the sole member.

The Best Strategy To Use For Offshore Trust Services

The offshore trustee rejected, and also he said that the cash had been spent in the LLC (offshore trust services). The court held the debtor in contempt of court. The court located that in spite of the rejection by the offshore trustee, the borrower still had the ability to access the funds as the single member of the LLC.